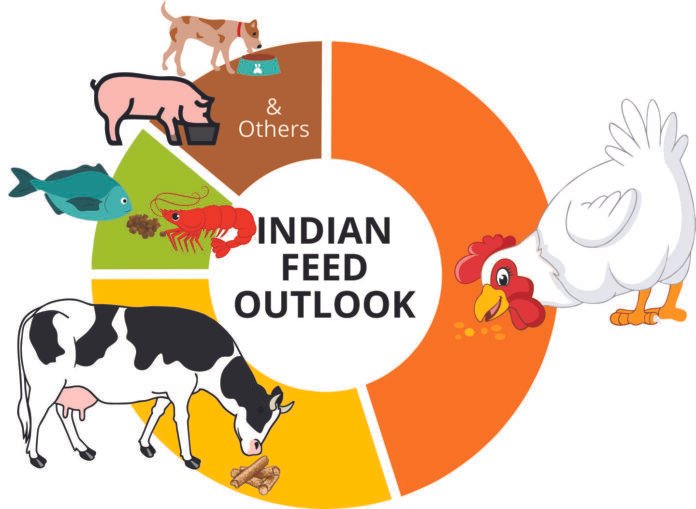

With an annual production exceeding 50 million metric tons (MMT), the Indian animal feed sector presents significant growth potential. Poultry continues to dominate the compound feed market, accounting for nearly 45% of the share in 2024, according to Mordor Intelligence. However, the aquaculture sector is rapidly gaining momentum, followed by cattle feed and other livestock segments. Meanwhile, India’s pet food industry, though still in its early stages, is witnessing exponential growth and evolving consumer demand.

To explore the current landscape and future prospects of this dynamic sector, TGTF connected with Dr. Amiya Dharmapada Nath, Head of Animal Feed Business & Vice President, and Dr. Dilip L. Waghmare, DGM – Nutrition, at Japfa Comfeed India. In this exclusive e-interview, they share insights into their professional journeys, the evolving opportunities in India’s feed industry, their recent expansions, and how they are navigating market uncertainties and emerging trends. Here are the edited excerpts from the conversation.

Could you take us through your professional journey?

Dr. Nath: My professional journey began in education — I taught chemistry at a school for two years after graduation. It instilled in me patience, discipline, and the value of shaping minds. I then spent three years as a chemist in an edible oil refinery, which introduced me to large-scale industrial operations and sparked my interest in food systems.

Dr. Nath: My professional journey began in education — I taught chemistry at a school for two years after graduation. It instilled in me patience, discipline, and the value of shaping minds. I then spent three years as a chemist in an edible oil refinery, which introduced me to large-scale industrial operations and sparked my interest in food systems.

During this time, I pursued an MBA and completed a course in corporate law. The real shift came when I entered the livestock sector, starting in a junior role at Japfa. Through hard work and a continuous learning mindset, I moved into leadership and today serve as Vice President, overseeing the entire feed business for Japfa India.

Recently, I completed a Doctorate in Strategic Management from SSBM, Geneva. My thesis — “Navigating Uncertainty Towards Sustainable Feed Production for Indian Poultry and Cattle Farmers” — is a reflection of my professional experiences translated into academic research.

What drives me is the sector’s direct impact on food security, farmer livelihoods, and rural development. From ground-level operations to strategic leadership, my mission remains the same: enable sustainable growth and empower India’s farmers.

Dr. Waghmare: After completing HSC from Bhiwandi, Thane, I graduated from Bombay Veterinary College in 2004. I completed my post-graduation in Poultry Science in 2006 and began my career with Japfa Comfeed India Pvt. Ltd. in 2007 as an Assistant Manager – Quality Control. Over the years, I advanced through multiple roles, including QC Manager (2015) and Senior Manager – Nutrition (2017), marking the beginning of my journey as a poultry nutritionist. Today, I serve as DGM – Poultry Nutrition, overseeing feed formulation for both commercial and breeder segments across India.

Veterinary College in 2004. I completed my post-graduation in Poultry Science in 2006 and began my career with Japfa Comfeed India Pvt. Ltd. in 2007 as an Assistant Manager – Quality Control. Over the years, I advanced through multiple roles, including QC Manager (2015) and Senior Manager – Nutrition (2017), marking the beginning of my journey as a poultry nutritionist. Today, I serve as DGM – Poultry Nutrition, overseeing feed formulation for both commercial and breeder segments across India.

Japfa has a strong presence in poultry and is diversifying into cattle and aqua feed. What’s the current scale and your outlook for these sectors?

Dr. Nath: Japfa India has a robust poultry ecosystem built over three decades — from feed production (39,000 MT/month across plants) to integration across breeder farms, hatcheries, contract farming, and processed chicken retail. This “feed-to-fork” approach ensures quality and market access for farmers.

In cattle feed, we see major opportunities driven by India’s rising milk demand and the shift towards nutritionally balanced feed. Our goal is to replicate the trust and scale we’ve built in poultry.

Aqua feed — both fish and shrimp — is a fast-growing sector, with India being among top seafood exporters. Our Kharagpur aqua feed plant is operational, with more capacity coming up. Farmers are responding well to our technical support and consistent product quality, which positions us strongly in these emerging segments.

What is your vision for Japfa’s integrated operations in India? Are there any expansion plans?

Dr. Nath: Our vision is to build an integrated protein ecosystem across poultry, dairy, aquaculture, and piggery — from feed to farming to food. We aim to be seen not just as a feed manufacturer, but as a rural development partner and sustainability champion.

Recent capital investments of nearly USD 40 million have gone into feed mill expansions, a new cattle feed facility, and our aqua feed plant at Kharagpur. Upcoming plans include:

- Additional aqua feed capacity in Andhra Pradesh

- Expansion of cattle feed in dairy-intensive regions

- Modernization of poultry integration units

Our integrated model is designed to deliver synergies across species and geographies while keeping farmer prosperity and sustainability at the core.

How does Japfa navigate global market uncertainties and ensure business resilience?

Dr. Nath: Volatility in raw materials, trade policies, climate, and consumer behavior demands a structured, adaptive approach. At Japfa India, our strategy rests on three key pillars:

- Raw Material Risk Management:

- We track global trends, diversify sourcing, and adopt least-cost formulations without compromising quality.

- Operational Efficiency & Integration:

- Investments in automation, modern feed mills, and end-to-end integration ensure quality, cost control, and resilience to external shocks.

- Sustainability & Farmer Engagement:

- We partner with farmers through training, advisory services, and promote balanced nutrition. Simultaneously, we align with global sustainability practices — optimizing energy use, reducing feed wastage, and pursuing relevant certifications.

Our multinational structure helps us bring innovations from other markets, like aqua feed advancements from Indonesia or cattle feed insights from China, into India. This synergy between global knowledge and local execution strengthens our long-term resilience.

Procurement is central to feed operations. How does Japfa manage procurement to balance cost, quality, and risk?

Dr. Nath: Feed makes up 60–80% of total livestock production cost. At Japfa, we take a strategic approach:

- Diversified Sourcing: We source maize, soybean meal, rice bran, etc., across states to minimize geographic risk.

- Supplier Partnerships & Digital Traceability: Ensures consistent quality and compliance with both BIS and internal global benchmarks.

- Global Advantage: Being part of the Japfa Group allows us to benchmark prices internationally, explore alternative ingredients like DDGS, and manage contracts effectively.

- Proactive Risk Management: We balance spot and forward contracts, monitor government policies (e.g., ethanol policies impacting corn supply), and collaborate closely with nutrition teams to ensure cost-effective yet optimal formulations.

This blend of global discipline and local agility ensures reliable, affordable, and quality feed for our customers, even during volatility.

How does Japfa ensure regulatory compliance and contribute to shaping industry standards?

Dr. Nath: Regulatory alignment is non-negotiable for us. We comply rigorously with FSSAI on food safety norms, ensure feed formulations and labelling practices align with BIS standards, and follow all state-level feed and veterinary regulations. All our feed mills undergo regular audits and maintain traceability protocols. Certifications include:

- ISO 9001:2015 (Quality Management)

- ISO 22000:2018 (Food Safety)

- HACCP

- NABL & ILAC-MRA accreditation (Labs in Supa & Kharagpur)

- BIS license for cattle feed

- GMP implementation

- Progress towards ISO 50001 (Energy Management), ISO 45001 (Occupational Health & Safety), and ISO 14001 (Environmental Management)

Beyond compliance, we actively participate in industry bodies, advocating for science-based regulations, responsible sourcing, and certification transparency. We aim to be a thought leader — not just adhering to standards but helping shape them for a more sustainable sector.

What recent R&D initiatives has Japfa India undertaken? How do these innovations enhance product performance and competitiveness?

Dr. Waghmare: As a technology-driven company, Japfa continuously invests in innovation. One key advancement is our formulation-to-packing integration, linking feed formulation software to SAP and PLC systems in our mills. This minimizes human error and ensures precision in production.

We’ve recently launched operations in cattle feed (West India) and aqua feed (East India), leveraging global expertise from our teams in China and Indonesia.

A notable product innovation is the 2.5 mm pellet starter feed for broilers (12–24 days), aimed at improving early growth performance and reducing feed wastage. Birds have shown a strong positive response in terms of feed intake and body weight gain.

The new pellet feed has led to better feed intake, higher early body weights, and reduced feed wastage due to larger particle size. Birds consume feed faster, minimizing energy loss and improving feed efficiency. These benefits contribute to both improved flock performance and cost savings—making our products more competitive in the market.

Has Japfa experimented with alternative raw materials recently? What were the outcomes?

Dr. Waghmare: Yes, leveraging our NABL-accredited labs, we routinely analyze and test alternative raw materials. One such material is Rice DDGS, which we have incorporated into layer feed.

By limiting inclusion to 6%, we observed positive outcomes in cost savings without compromising performance—despite literature suggesting up to 15% inclusion. However, the key challenge remains the variation in nutritional content, which depends on the source of grain and production methods. With careful quality control, Rice DDGS has proven to be a viable, sustainable option.

How do you evaluate feed performance and digestibility in field conditions?

Dr. Waghmare: We assess feed effectiveness using a combination of:

- Performance Metrics

- Feed Intake

- Average Daily Gain (ADG)

- Feed Conversion Ratio (FCR)

- Egg Production or Milk Yield

- Reproductive and Health Parameters

- Digestibility Assessments: To understand how efficiently animals break down and absorb nutrients from the feed.

- Fecal Output Method: Using internal markers to estimate digestibility

- Near-Infrared Reflectance Spectroscopy (NIRS) Analysis: Portable, rapid nutrient analysis

- Lab Sampling: Feed and feces tested for nutrient breakdown

- Experimental Design

Controlled on-farm trials with replicates and randomization to minimize bias.

- Data & Farmer Feedback

Data is tracked using digital tools; farmer insights on palatability, performance, and ease of use are invaluable in evaluating success in real-world conditions.

In a competitive feed market, how can customers differentiate high-quality feed?

Dr. Waghmare: Key indicators include:

- Nutritional Profile: Balanced protein, fat, fiber, moisture, and mineral content aligned with species needs. (Tip: Compare the feed’s nutrient profile against the Nutrient Requirements from organizations like NRC (National Research Council) guidelines for specific animals).

- Ingredient Transparency: Use of high-quality inputs; absence of fillers or banned substances.

- Functional Additives: Inclusion of vitamins & minerals, enzymes, probiotics/prebiotics, antioxidants, organic acids, and mycotoxin binders.

- Safety Standards: Free from contaminants like mycotoxins, heavy metals, chemical residues, and pathogens. (Tip: Consider third-party laboratory test reports, certifications e.g., GMP+, ISO 22000, HACCP).

- Digestibility & Efficiency: Better FCR and visible performance improvements.

- Physical Traits: Consistent texture, color, smell, and packaging.

- Certifications: ISO 22000, GMP+, BIS, HACCP, etc., assure quality.

- Customer Trust: Brand reputation, technical support, and proven on-field performance.

Could you share current industry estimates for feed production in India and how you see demand evolving?

Dr. Nath: While exact numbers vary, based on available data and internal estimates:

- Poultry Feed: ~25–30 MMT annually

- Poultry Meat Production: ~5 MMT

- Aqua Feed: Estimated at ~5.5 MMT, with a market size of USD 3.25B in 2025 projected to reach USD 4.57B by 2030 (7% CAGR)

- Cattle Feed: ~15 MMT; valued at USD 4.5–5B

- Total Compound Feed (all species): Over 50 MMT, projected to grow at 6–7% CAGR

Demand Outlook:

- Poultry Feed: Expected growth of 4–8% annually, driven by rising protein consumption and improved infrastructure.

- Aqua Feed: High growth (7%+ CAGR), especially with export opportunities.

- Cattle Feed: Moderate but steady growth due to increasing formalization and productivity focus in dairy.

Risks to Watch:

Raw material price volatility, climate-related impacts, and policy shifts (e.g., maize diverted to ethanol). We monitor these closely and adapt production and investment plans accordingly.