Think Grain Think Feed has completed its 4th Indian feed survey with 102 participants, including 42 cattle feed producers, 39 poultry feed producers, 9 producers of feed for multiple species (including aquaculture and swine), and 12 nutritionists or consultants, representing more than 70 feed mills. The total monthly production capacity is 2.1 MMT, with an average utilization rate of over 80%. This year, we further engaged with some participants to gain a deeper understanding of the challenges, opportunities, and potential solutions for feed millers.

including 42 cattle feed producers, 39 poultry feed producers, 9 producers of feed for multiple species (including aquaculture and swine), and 12 nutritionists or consultants, representing more than 70 feed mills. The total monthly production capacity is 2.1 MMT, with an average utilization rate of over 80%. This year, we further engaged with some participants to gain a deeper understanding of the challenges, opportunities, and potential solutions for feed millers.

Summary

- 34 respondents mentioned an increase in maize usage, while 23 reported a decrease, and the rest used the same maize quantity in formulations.

- Maize usage increased by 8.3% among players manufacturing 1.13 MMT of feed per month and decreased by 9.8% among those manufacturing 0.18 MMT

- 35% of respondents preferred broken rice as an alternative energy source, followed by 27% who preferred pearl millet (bajra) and sorghum (jowar), while the rest opted for multiple other options.

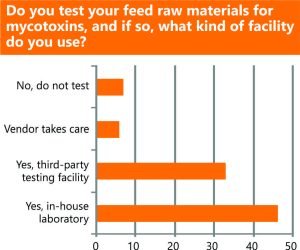

- A maximum of 1000 samples per month analysed for mycotoxin testing.

- Vitamins became the most volatile additive of the year with 41%, followed by amino acids at 37% and trace minerals at 11%, with others trailing behind.

- 57% of respondents predicted maize to be the most volatile ingredient in Q1 2025.

- Only 16% of feed millers made large-scale purchases.

- More than 70% of customers using Indian machinery reported being satisfied or very satisfied.

Maize remains a cornerstone of feed formulations in India, with most participants indicating either stable or increased usage. This highlights maize’s resilience as a preferred energy source despite fluctuations in its price and availability. However, the absence of a significant decrease suggests that alternative energy sources are complementing rather than replacing maize. Additionally, quality remains a top concern for the industry.

Alternate Energy Source Preferences

Indian feed manufacturers are diversifying their energy sources to mitigate costs and manage supply chain risks. Alternatives such as broken rice, wheat, and bajra are gaining traction across different regions, reflecting India’s agricultural diversity and the industry’s focus on cost-effective feed solutions. This shift highlights the need for policies that support the cultivation of alternative grains to meet the growing demands of the feed industry.

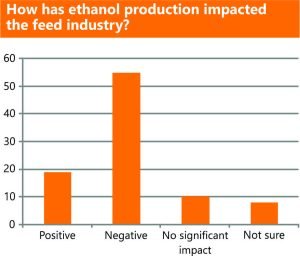

A majority of respondents emphasized the negative impact of ethanol production, primarily due to increased competition and rising maize prices. In India, the government’s ethanol blending program, though beneficial for green energy initiatives, has posed challenges for feed manufacturers. Balancing the demands of the energy and feed sectors is crucial to prevent disruptions in livestock productivity and profitability.

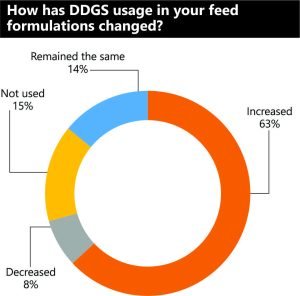

The increasing use of DDGS (Distillers Dried Grains with Solubles) aligns with India’s emphasis on protein-enriched feed formulations. As a byproduct of ethanol production, DDGS offers a dual advantage: meeting protein requirements while repurposing industrial byproducts. Moving forward, it is essential for ethanol manufacturers to prioritize DDGS quality by investing in dryers and ensuring a consistent supply of high-quality raw material for the feed industry.

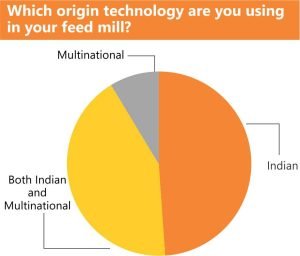

Satisfaction with Feed Mill Technology

High satisfaction levels with both Indian and multinational feed mill technologies reflect India’s gradual modernization of feed production facilities. However, continued investment in automation and precision technologies could further enhance efficiency and competitiveness. Indian manufacturers must capitalize on adopting newer technological innovations to capture India’s evolving livestock sector and sustain growth.

High satisfaction levels with both Indian and multinational feed mill technologies reflect India’s gradual modernization of feed production facilities. However, continued investment in automation and precision technologies could further enhance efficiency and competitiveness. Indian manufacturers must capitalize on adopting newer technological innovations to capture India’s evolving livestock sector and sustain growth.

Mycotoxin Concerns

Mycotoxin contamination presents a significant threat to feed safety and livestock health in India, particularly in humid regions susceptible to fungal growth. The survey reveals increasing awareness among manufacturers regarding mycotoxin risks, with the majority either maintaining in-house testing facilities or utilizing third-party t

Mycotoxin contamination presents a significant threat to feed safety and livestock health in India, particularly in humid regions susceptible to fungal growth. The survey reveals increasing awareness among manufacturers regarding mycotoxin risks, with the majority either maintaining in-house testing facilities or utilizing third-party t

esting services. Continued research and education on mycotoxin management are crucial to minimizing contamination and ensuring both feed safety and, ultimately, food safety.

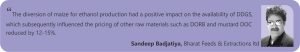

Risk Management in Feed Production

Risk Management in Feed Production

The Indian feed industry faces multiple risks, including supply chain disruptions, raw material shortages, and price volatility. Effective risk management strategies, such as diversifying raw material sources, securing contracts with reliable suppliers, and adopting predictive analytics, are essential. Integrating risk assessment tools can help manufacturers anticipate challenges and adapt quickly, ensuring continuous production and sustained profitability.

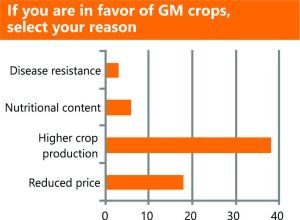

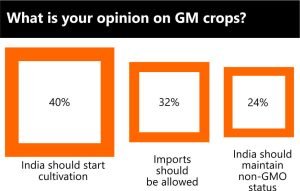

GM Crops Preferences

GM Crops Preferences

Opinions on GM crops in India remain divided. While a majority of respondents highlight benefits such as higher yields and cost reductions, others express concerns about environmental and ethical implications, as well as doubts about achieving the anticipated improvements in crop yields or price reductions. Given India’s heavy reliance on agriculture, the government’s stance on GM crops will be pivotal in shaping the future of the sector.

Opinions on GM crops in India remain divided. While a majority of respondents highlight benefits such as higher yields and cost reductions, others express concerns about environmental and ethical implications, as well as doubts about achieving the anticipated improvements in crop yields or price reductions. Given India’s heavy reliance on agriculture, the government’s stance on GM crops will be pivotal in shaping the future of the sector.

Satisfaction with Feed Mill Technology

Satisfaction with Feed Mill Technology

High satisfaction levels with both Indian and multinational feed mill technologies reflect India’s gradual modernization of feed production facilities. However, continued investment in automation and precision technologies could further enhance efficiency and competitiveness. Indian manufacturers must capitalize on adopting newer technological innovations to capture India’s evolving livestock sector and sustain growth.