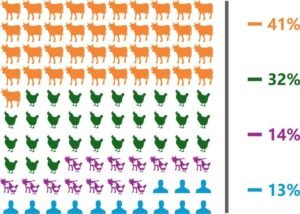

Think Grain Think Feed has compiled its 5th Indian Feed Survey, drawing insights from 135 participants. The respondents include 56 cattle feed producers, 43 poultry feed producers, 19 multi-species feed manufacturers (covering aquaculture and swine), and 17 nutritionists and consultants, collectively representing over 170 feed mills across India.

Think Grain Think Feed has compiled its 5th Indian Feed Survey, drawing insights from 135 participants. The respondents include 56 cattle feed producers, 43 poultry feed producers, 19 multi-species feed manufacturers (covering aquaculture and swine), and 17 nutritionists and consultants, collectively representing over 170 feed mills across India.

The survey estimates a total monthly production capacity of 4.37 million metric tonnes (MMT), with an average capacity utilization exceeding 90%.

Detailed findings and expert perspectives are presented in the report below, along with curated quotes from industry leaders.

Summary

- Corn and energy source prices showed a clear reversal during the year. While 57% of

respondents reported price increases in Q1, the share steadily declined to 21% by Q4. Conversely, expectations of price decreases strengthened sharply, rising to nearly 62% in Q4, indicating a strong downward price sentiment toward year-end.

respondents reported price increases in Q1, the share steadily declined to 21% by Q4. Conversely, expectations of price decreases strengthened sharply, rising to nearly 62% in Q4, indicating a strong downward price sentiment toward year-end. - Average corn prices during the survey period largely ranged between INR 19.4–24.9 per kg, with reported lows of INR 17 and highs reaching INR 28, reflecting significant price volatility across regions and time periods.

- Production capacity is largely concentrated in smaller feed mills, with 55% of respondents operating below 10,000 tonnes, followed by 29% in the 10,000–50,000 tonne range. Only 17% of respondents have capacities above 50,000 tonnes, indicating limited large-scale capacity within the sample.

- Mycotoxin contamination emerged as the biggest challenge in maize, reported by 69% of respondents, followed by inconsistent quality and price volatility, highlighting persistent raw material risk in feed formulation.

- 83% of respondents preferred broken rice as an alternative energy source, followed by 13% preferring millet or wheat, while the remainder opted for multiple other options.

- Soybean prices showed a clear reversal during the year. In Q1 and Q2, a larger

share of respondents reported stable to declining prices, while the proportion indicating price increases remained below 30%. Sentiment shifted in Q3, with 43% reporting price increases, and strengthened sharply in Q4, where over 76% of respondents indicated rising soybean prices, while expectations of price declines were negligible.

share of respondents reported stable to declining prices, while the proportion indicating price increases remained below 30%. Sentiment shifted in Q3, with 43% reporting price increases, and strengthened sharply in Q4, where over 76% of respondents indicated rising soybean prices, while expectations of price declines were negligible. - Average soybean meal (SBM) prices during the survey period largely ranged between INR 33.8–42.6 per kg, with reported lows of INR 30 and highs reaching INR 50, indicating significant price volatility.

- SBM usage is skewed toward smaller volumes, with 55% of respondents consuming less than 2,000 tonnes. About 21% use more than 5,000 tonnes, including 19% exceeding 10,000 tonnes, while nearly 5% reported not using SBM at all.

- Adulteration emerged as the biggest challenge in SBM, cited by 50% of respondents, with DDGS and silica identified as the most common adulterants. Other key concerns included price volatility and inconsistent protein quality, impacting formulation reliability and performance outcomes.

- Nearly 79% of respondents preferred DDGS and rapeseed meal as alternateprotein sources; however, maize-based DDGS was associated with significant challenges related to fungal contamination and mycotoxins, limiting its wider acceptance.

- DDGS inclusion levels remain moderate, with 2–5% usage in poultry diets and higher inclusion of 5–10% in dairy rations, reflecting species-specific risk considerations.

- De-oiled Rice Bran (DORB) is widely used, with over 97% of respondents incorporating it into their formulations. Most users reported inclusion levels in the 10–15% range, while 14% indicated usage exceeding 20%, underscoring its importance as a cost-effective energy and protein source.

- Average prices of DORB ranged between INR 11.3-14.7 per kg, with reported values spanning from a minimum of INR 9 to a maximum of INR 18.5.

- Stocking remained the primary risk management strategy adopted by feed millers and integrators.

- Over 90% of respondents reported an expected increase in feed production capacity over the next 12–24 months, with expansion levels ranging from less than 5% to as high as 50%. The primary focus of expansion is cattle feed, followed by poultry feed.

India’s animal nutrition industry is undergoing a series of structural shifts that are quietly redefining feed manufacturing, raw material sourcing, and farm-level productivity. From changing poultry feed dynamics to quality-linked milk procurement and regional feed corridors, industry experts point to a sector transitioning from volume-driven growth toward efficiency, quality, and resilience.

Poultry Feed Manufacturing Moves Beyond Broilers

Fifteen years ago, broiler feed dominated the commercial feed landscape. Today, increasing integration in the broiler sector has steadily pushed independent feed millers toward layer feed manufacturing.

Fifteen years ago, broiler feed dominated the commercial feed landscape. Today, increasing integration in the broiler sector has steadily pushed independent feed millers toward layer feed manufacturing.

“Fifteen years ago, most commercial feed millers were focused on broiler feed; however, increasing integration in the broiler sector has steadily pushed independent millers toward layer feed manufacturing,” said Dr SK Bhardwaj, poultry expert.

This shift has coincided with persistent challenges in grain handling, particularly maize moisture management. High post-harvest moisture remains a critical risk factor for feed quality and storage stability.

“High maize moisture remains a persistent challenge, sun drying is often preferred over short-duration batch drying, as excessive heat can ‘cook’ the grain, alter its texture, elevate toxin risks, and shorten storage life,” Dr Bhardwaj noted. While controlled drying below 60°C offers a technical solution, high capital costs have limited wider adoption.

Raw Material Quality Under Pressure

Across both poultry and dairy feed segments, securing consistent-quality raw material has emerged as the dominant concern for manufacturers.

emerged as the dominant concern for manufacturers.

“For feed manufacturers, securing quality raw material is the biggest challenge,” said Dr S. Ramamoorthi of Krishi Nutrition. “The damaged soybean crop in Maharashtra and reduced seed size signal potential stress for the next crop cycle.”

Maize quality, in particular, has shown visible deterioration in key sourcing regions. According to Dr S S Pattabhirama of Nanda Group, recent procurements from parts of Karnataka highlight a worrying trend.

“Maize quality has visibly deteriorated, particularly in recent procurements from Davanagere, Chitradurga, and Haveri, where grain counts have risen to 400 or more per 100 grams compared to the earlier norm of around 350—an indicator of immature harvesting and lower nutrient density,” he said.

“Maize quality has visibly deteriorated, particularly in recent procurements from Davanagere, Chitradurga, and Haveri, where grain counts have risen to 400 or more per 100 grams compared to the earlier norm of around 350—an indicator of immature harvesting and lower nutrient density,” he said.

Soybean meal quality has also become more variable. “In an earlier assignment with an integrator operating its own soya extraction plant, we consistently achieved SBM with just 0.5% silica. Today, sourcing from commercial extraction plants typically yields SBM with silica levels as high as 2%,” Dr Pattabhirama added, noting the implications for feed efficiency and performance.

DDGS Use and the Soybean Meal Adulteration Debate

The increasing use of DDGS in poultry and cattle feed has added another layer to the ongoing debate around protein sourcing and soybean meal quality. According to DN Pathak of Soybean Processors Association of India (SOPA), the issue is often misunderstood and, in some cases, misrepresented.

The use of DDGS in poultry feed has drawn attention, though primarily as a limited partial replacement for soybean meal. “Inclusion is currently restricted to about 3–4%, as soybean meal cannot be fully replaced due to its superior nutritional profile and concerns around aflatoxin contamination in maize-based DDGS,” he said.

replacement for soybean meal. “Inclusion is currently restricted to about 3–4%, as soybean meal cannot be fully replaced due to its superior nutritional profile and concerns around aflatoxin contamination in maize-based DDGS,” he said.

Pathak rejected claims that DDGS is widely used to adulterate soybean meal, calling such allegations largely unfounded and driven by commercial pricing dynamics. He pointed out several large poultry integrators operate their own soy processing plants and are well aware that nearly 96% of soybean meal production costs are linked to raw material, leaving little scope for wide price variation.

According to Pathak, pressures to procure soybean meal below production cost, extended payment cycles, and unilateral quality testing practices often contribute to disputes over quality.

He further noted that most processors refuse to compromise on quality and insist on fair pricing, while buyers seeking cheaper alternatives gravitate toward suppliers willing to meet those price expectations—only to later raise concerns over quality.

He emphasized that these challenges can be best addressed through constructive dialogue and closer collaboration between the soy and poultry sectors to strengthen domestic supply chains and ensure fair competition, particularly as global price differentials increasingly influence import considerations.

Infrastructure Gaps Add to Cost Pressures

Industry leaders argue that many quality and cost challenges stem from inadequate grain infrastructure.

Industry leaders argue that many quality and cost challenges stem from inadequate grain infrastructure.

“India lacks public infrastructure for grain cleaning, drying, and storage,” said Ashok Kumar of Maa Integrators. “Recent government procurement costs around INR 4,700 per tonne for collection, transport, and handling can be reduced to nearly INR 2,000 per tonne with proper material handling and drying infrastructure.”

Kumar also highlighted the untapped potential of by-product utilisation in poultry processing. “Very soon, we will be processing around 2 crore birds per day, and almost 30% is lost during processing. If this can be efficiently rendered, the waste could generate nearly 14 lakh kilograms of poultry meal daily, significantly reducing pressure on grains.”

Dairy Sector Shifts Toward Quality and Science

In the dairy sector, experts point to a gradual but irreversible shift from volume-based to quality-linked production.

quality-linked production.

“The dairy sector is undergoing a gradual but irreversible shift from volume-based to quality-linked production,” said Amit Mittan of De Heus. “Organised milk procurement under White Revolution 2.0—combined with fat- and SNF-linked pricing—is accelerating adoption of balanced rations and feed quality systems.”

Scientific feeding is already delivering measurable results. Dr Avinesh Sharma of Sunjin India Feeds cited large dairy farms in Punjab where structured feeding programs have raised productivity significantly.

“Proper implementation of scientific feeding can increase milk yields by 15–20% in HF and crossbred cows and 8–10% in indigenous breeds,” he said, noting average yields rising from 20 to nearly 25 litres per animal by 2025.

“Proper implementation of scientific feeding can increase milk yields by 15–20% in HF and crossbred cows and 8–10% in indigenous breeds,” he said, noting average yields rising from 20 to nearly 25 litres per animal by 2025.

Punjab’s dairy success offers a replicable model. “The state’s success is driven by 100% artificial insemination, high-quality feed and fodder—especially maize silage—and strong veterinary infrastructure,” Dr Avinesh added.

Regional Growth Corridors Emerge

India’s feed demand remains highly regionalised, shaped by species concentration and ingredient availability.

“Northern and western peri-urban milk sheds are driving demand for premium cattle nutrition solutions, while southern India remains the core poultry feed corridor,” Mittan said. Eastern and central regions, he added, represent the next phase of growth.

Several states remain underserved despite strong potential. “Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and the North-Eastern region lack access to advanced farm-level services, yet represent the future growth opportunity for the dairy feed industry,” Dr Avinesh noted.

Buffalo Nutrition: An Untapped Lever

Buffalo-centric nutrition is emerging as a major opportunity.

“At Gokul, nearly half of our 18 lakh litres of daily milk come from buffalo farms,” said Dr V. D. Patil of Gokul Milk Union. “Nutrition is the most powerful yet underutilised lever for enhancing buffalo productivity and fertility.”

Despite higher fat content in buffalo milk, compound feed penetration remains low. “Buffaloes can digest tougher fibre, but fibre alone is not enough to produce high-quality milk,” Dr Patil said, pointing to the need for formulations tailored specifically to buffalo requirements.

Poultry Industry: Discipline Restores Balance

The poultry sector saw a largely average performance in 2025, with early losses offset by improved discipline later in the year.

The poultry sector saw a largely average performance in 2025, with early losses offset by improved discipline later in the year.

“Lower DOC placements, tighter control on body weights below 2.5 kg, and higher mortality collectively contributed to restoring overall profitability,” said Dr Amiya Nath, JAPFA Comfeed India.

Looking ahead, Dr Nath emphasised the role of regulation. “Regulation of DOC (Day-Old Chick) production through government intervention is critical. In the broader livestock sector, scientific feeding of just the top 5% high-yielding cattle can significantly improve overall productivity.”

Consolidation and the Road Ahead

Farm consolidation is gradual but visible, particularly in Punjab, Haryana, and peri-urban buffalo belts.

buffalo belts.

“Nearly 95% of cattle are still owned by smallholders, but among the remaining 5%, peri-urban farms—largely buffalo-based—are significantly larger,” noted Dr Pradeep Mahajan, dairy expert.

Fair and transparent milk pricing is expected to be the first trigger for consolidation, followed by stricter enforcement of quality standards.

Despite ongoing risks from climate variability, fodder stress, and disease outbreaks, the broader outlook remains steady.

“Overall, 2025 has been a positive and stable year for the dairy sector, supported by consistent demand and relatively stable farm economics,” added Dr Mahajan.

As India’s feed industry navigates rising complexity, experts agree that quality, infrastructure, and scientific feeding—not volume alone—will determine the next phase of sustainable growth.